Update on OIOUBL 3

Here you can read all about what we know at this point about the expected OIOUBL version 3. We stay updated on the situation, in order to provide you with the latest news about the release of the new format. Read more about some of the conditions, you as a customer should be aware of, with regards to the transition to OIOUBL 3.

The Danish Business Authority has announced the initial draft of invoices and credit notes in OIOUBL version 3 to be released in April 2024. The material describes the main changes that apply in comparison to the existing material is found on the Danish Business Authority’s website.

Current deadlines for OIOUBL 3

Below is the timeframe, the Danish Business Authority is working with at the moment:

| November 2024: | Release Candidate: OIOUBL 3 Invoice, Credit note and Receipt documents |

| May 2025: | Final Release: OIOUBL 3 Invoice, Credit note and Receipt documents |

| November 2025: | Deadline for Implementation of OIOUBL 3: Invoice, Credit note and Receipt documents |

| May 2026: | Deadline for Phasing out previous OIOUBL versions |

Other OIOUBL 3 documents (Product master data files, Reminders, Goods receipts, Order documents and Catalog documents) will be released during 2024.

Beware that the deadlines may change accordingly to comments being made on the timeframe.

Are you sending or receiving OIOUBL documents yourself?

If your OIOUBL documents are currently being generated in your own systems, or if you receive OIOUBL documents and import them directly into your accounting- or finance systems, then you need to pay special attention to the deadlines above, as there will be several changes to the new OIOUBL 3 format.

You should prepare for the task of updating the old format to ensure it continues to meet the requirements, or the task of updating the interface for your finance system, so that the new format kan be read correctly.

Also beware that the material mentions new requirements for receiving receipts.

It can be comprehensive to manage these tasks on your own. If you wish to outsource the job, we can in VAX 360 make the conversions that ensure the necessary formats for both sending and receiving.

If you use a standardized accounting system (approved by the Danish Business Authority according to the Accounting Act), the system provider will likely make sure that all OIOUBL 3 requirements are met.

How do we handle the new format at mySupply?

If we already handle your invoicing flow and convert your documents to the correct OIOUBL invoices prior to sending, we will continue to do so when OIOUBL 3 is released. This is also the case if we receive and convert your OIOUBL invoices and credit notes today.

In the material it is proposed that all senders of invoices must be able to receive an invoice response. If this is decided, there will be a need to make an agreement regardring registration in the Nemhandel register and how invoice responses should be handled.

Peppol BIS 3 vs. OIOUBL 3

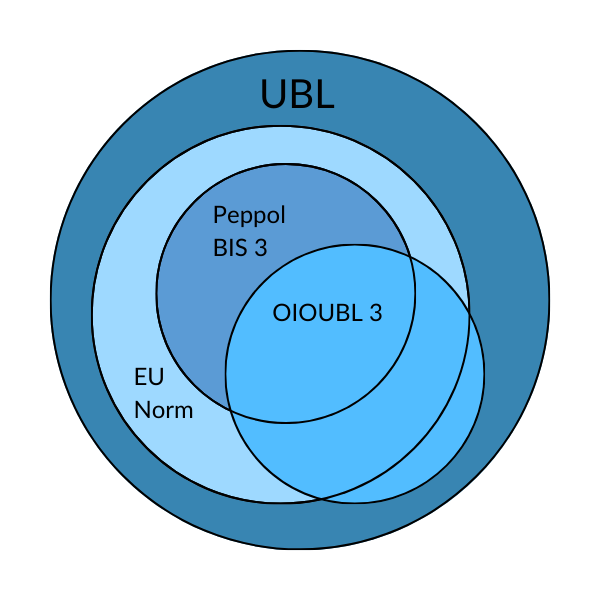

Below is an illustration of how the new OIOUBL version 3 will compare to the excisting EU Norm and Peppol BIS 3.

Below is an illustration of how the new OIOUBL version 3 will compare to the excisting EU Norm and Peppol BIS 3.

UBL (Unified Business Language) is the international ISO standard that dictates the syntax for invoice documents.

The EU Norm is conducted as a subset for, or a part of the UBL Standard, as only a part of the elements for invoices are used. Peppol BIS 3 is also conducted as a subset for the EU Norm. In the EU Norm, a subset that complies with all the regulations for the norm (compliance), but further enhances some of them, is called a “CIUS” (Core Invoice Usage Specification).

The material states that OIOUBL 3 is “conformant” with the EU Norm. This means, that there are elements that are not part of the Norm, and thereby not part of Peppol, but is used as an extension herefore.

Peppol BIS 3 and OIOUBL 3 will therefore continue to be two parallel standards.

What’s new?

In the material from the Danish Business Authority, the changes that are expected to be implemented with OIOUBL 3 is described, and in the spreadsheet is the UBL Syntax inckluding field descriptions and cardinality for both Peppol, the existing OIOUBL format, and the OIOUBL 3 format.

Below are some of the main differences.

The process

In OIOUBL 3, there is a significant difference in the process regarding receiving responses, as there is now a distinction between “MLR” (Message Level Response) and “Invoice Response.” MLR is the technical response returned if the sent invoice does not comply with its ruleset. An Invoice Response is the business-related invoice response that can be returned from the customer if they assess that the content of the invoice, such as amount, missing discounts, or the number of billed items, is incorrect. It should be noted that the customer can return multiple invoice responses for the same invoice, with codes indicating where the customer is in the invoice process.

Also, note that if OIOUBL 3 is implemented as described in the consultation material, the current “NES5” profile, where suppliers only send documents, will disappear. Therefore, you must register in the Nemhandel register due to the fact that suppliers must be at least able to receive an invoice response.

If you have an existing order/invoice flow where you match an incoming invoice to a sent order, be aware that there will be some differences, especially regarding the use of code lists, until the order documents are also upgraded to version 3.

Other differences

- New document types

- A more comprehensive list of invoice- and credit note types has been added. This means, that there can be multiple documents that have different handling requirements.

- New profiles

- ”OIOUBL BIS Invoice incl. response””OIOUBL BIS Message Level Response”

- Both profiles requires the invoice sender to be able to receive responses as return documents.

- New and edited code lists

- New code lists are introduced for e.g. identification of discounts and fees and for “objects”.

- There are changes to some code lists e.g. units of measure (UOM), where several UOM codes are prefixed with an “X”, so for example the code for “package” becomes “XPK” instead of “PK”.

- Changes to the specification of VAT and duties

- Only VAT is indicated in the “TaxTotal” class in the future, while (line-) duties are moved to the “AllowanceCharge” class, which is currently only used for discounts and fees that are settled between the parties.

- Calculation of the line totals for discounts and fees on the invoice line

- The calculation model for the line total is changed, when a discount or fee is specified on the line, so that the discount/fee is not included in the unit price, but in the line total.

- Changes to the specification of the payment method

- Payment date is moved from payment information to the “DueDate” element on the invoice document level.

- Only one payment method is permitted in the future.

- The usage of objects for e.g. specification of service receiver

- In OIOUBL 3, a new concept called “object” is introduced, which can be used at document- or line level to identify the “object” that the invoice/line relates to, for example a case number.

- A “service receiver” can be identified as an object.

- The code for identifying “parties” is changed, so that e.g. the GLN recepient endpoint will be identified with the code “0088” instead of “GLN”, and CVR numbers with the code “0184! instead of “DK:CVR”.

See the material for more information.

Contact us with ny questions about OIOUBL 3

Regardless of whether you handle your OIOUBL documents in your own systems, or if we convert them for you, feel free to contact us with any questions.